puerto rico tax incentive program

INCOME TAX RETURN FOR EXEMPT BUSINESSES UNDER THE PUERTO RICO INCENTIVES PROGRAMS. Now known as Chapter 3 of the Incentives Code Puerto Ricos Act 20 was originally known as the Export Services Act.

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22

Aggressive Tax Incentives for Attracting Business.

. Has a Puerto Rico corporate income tax rate of 4 businesses located in Vieques or Culebra and businesses with income under 3MM are eligible for only 2 tax Distributions are taxed at 0 to PR. The tax incentives enjoyed by Individual Resident Investors. 100 tax exemption from Puerto Rico income taxes on all dividends.

Act 22 Individual Investors Act. Feature films short films documentaries television programs series in episodes mini-series music videos national and international commercials video games and post-production projects. 0 capital gain tax for Puerto Rico residents.

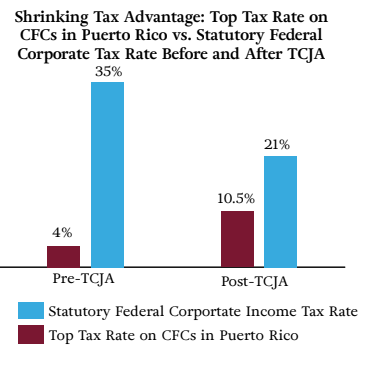

4 corporate tax rate for Puerto Rico services companies. In a recent attempt to strengthen its economy and attract investors the local government has stepped up its economic and tax incentives for those wanting to do business. The two well-known Puerto Rican tax incentives are Export Services formerly Act 20 and Individual Resident Investor formerly Act 22 but they arent the only tax incentives Puerto Rico offers.

It systematizes dozens of incentive acts Acts 20 and 22 are just the most famous ones that Puerto Rico has enacted over the years. This is the time to invest in puerto rico. Puerto Rico offers the security and stability of operating in a US jurisdiction with an array of special tax incentives for foreign direct investment that can be found nowhere else in the world.

The legislation allows Puerto Rico to offer qualifying businesses that export services from the island nation the opportunity to cut their corporate tax rate to a mere 4. 22 which provides tax. Under the Puerto Rico Incentives Programs.

Learn More LEARN MORE ABOUT THE BENEFITS OF ACT 60 AND ITS INCENTIVE PROGRAMS. To be eligible investors must donate 10000 to nonprofit entities in Puerto Rico. If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investors.

Benefits of establishing relocating or expanding businesses in Puerto Rico. 90 exemption from municipal and state taxes on property. Puerto Rico offers a highly attractive incentives package that includes a fixed corporate income tax rate one of the lowest in comparison with any US.

To promote the necessary conditions to attract investment from industries support small and medium merchants face challenges in medical care and education simplify processes optimize and provide greater transparency Act 60-2019 was signed which establishes the new Puerto Rico Incentive Code. The tax incentive is guaranteed for 20 years as long as you comply with the requirements. The fiscal impact of approximately 590M in credits and monetary stimulus excluding tax exemptions and prime taxes.

Tax and incentives guide. In the past few foreign investors have found the EB-5 Classification attractive due to the tax consequences on the investors worldwide income upon moving to the United States. Puerto Rico offers several Acts that provide tax and business incentives to qualifying business operations that decide to establish in Puerto Rico.

Jurisdiction various tax exemptions and special deductions training expenses reimbursement and special tax treatment for pioneer activities. Under this incentive all eligible export goods and services business income. More recently these two acts were updated and combined in a new law called Act 60.

Puerto Ricos Act 185 Tax Incentive Program The purpose of the Act 185 tax incentive is to establish the Private Equity Fund Act to promote the development of private capital in Puerto Rico. 2003 1 COMMONWEALTH OF PUERTO RICO DEPARTMENT OF THE TREASURY PO BOX 9022501 SAN JUAN PR 00902-2501. Is exempt from US taxation under IRC 933 and IRC 937.

It offers a total tax exemption on passive income generated or accumulated once the individual is a bona fide resident of Puerto Rico. Those two tax acts offer low to no taxes on certain types of income. A Puerto Rico bona fide resident is.

A Puerto Rican corporation thats engaged in certain types of service businesses only pays Puerto Rican tax of 4. Make Puerto Rico Your New Home. In late June 2019 Puerto Rico completed a massive overhaul of their tax incentives enacting the Incentives Code.

Act 20 Export Services Act. Part of Puerto Ricos government tax incentive programs require buying a home within the first two years of a move and you have to pay for. INCOME TAX RETURN FOR EXEMPT BUSINESSES UNDER THE PUERTO RICO INCENTIVES PROGRAMS.

Qualifying industries such as scientific research and development manufacturing operations recycling businesses high technology film agriculture hospital facilities hotels and related tourist activities are eligible for full or partial. Puerto Rico enjoys fiscal autonomy which means that it can offer very attractive tax incentives not available on the mainland US with the advantages of being in a US. A Puerto Rican corporation thats engaged in certain types of service businesses only pays Puerto Rican tax of 4.

On 2 September 2010 Act 132 Real Property Market Stimulus Act was enacted to create an incentive program to facilitate the purchase of homes and other real property by granting different exemptions from taxation on property tax and income tax. This Act encourages the Relocation of Individual Investors to Puerto Rico. In Puerto Rico are perhaps the most impressive of all Puerto Rican tax incentives.

MESSAGE FROM THE SECRETARY OF. Act 73 of May 28. The new law does NOT eliminate the existing incentives.

100 tax exemption from Puerto Rico income taxes on all interest. In particular this act aims to encourage the purchase of newly constructed residential real property suitable for. Incentives for export activities or to attract investment to develop the Puerto Rico economy in a way that is profitable for Puerto Ricos Government tourism manufacture for exportation exportation services and international investment.

Puerto Ricos recently approved Act to Promote the Transfer of Investors to Puerto Rico Act 22 of January 17 2012 Act No. COMMONWEALTH OF PUERTO RICO DEPARTMENT OF THE TREASURY Income Tax Return for Exempt Businesses Under the Puerto Rico Incentives Programs Part I TAXABLE YEAR BEGINNING ON _____ ____ AND ENDING ON _____ _____ Payment Stamp Contracts with Governmental Entities Yes No CHANGE OF ADDRESS Yes No 2000 RETURN Spanish English. This is done through the formation of investment capital funds aimed at investing in companies that do not have access to public markets and establish the applicable.

100 tax exemption from Puerto Rico income taxes on all short-term and long-term. Then under a law referred to as Act 60 formerly Act 20 and Act 22 Puerto Rico has enacted several tax incentives the two most popular of which are as follows. One of the most well-known Puerto Rican tax incentives the Individual Resident Investor tax incentive is available to any person who was not a resident of Puerto Rico for the 10 tax years preceding July 1 2019 and who becomes a resident before December 1 2035.

Local government has legislated a series of incentives to attract investment of which EB-5 Visa program participants can also take advantage. 100 exemption from municipal license taxes and other municipal taxes.

Cares Act A Lifeboat For Puerto Rico Insights Dla Piper Global Law Firm

Puerto Rico Offers The Lowest Effective Corporate Income Tax

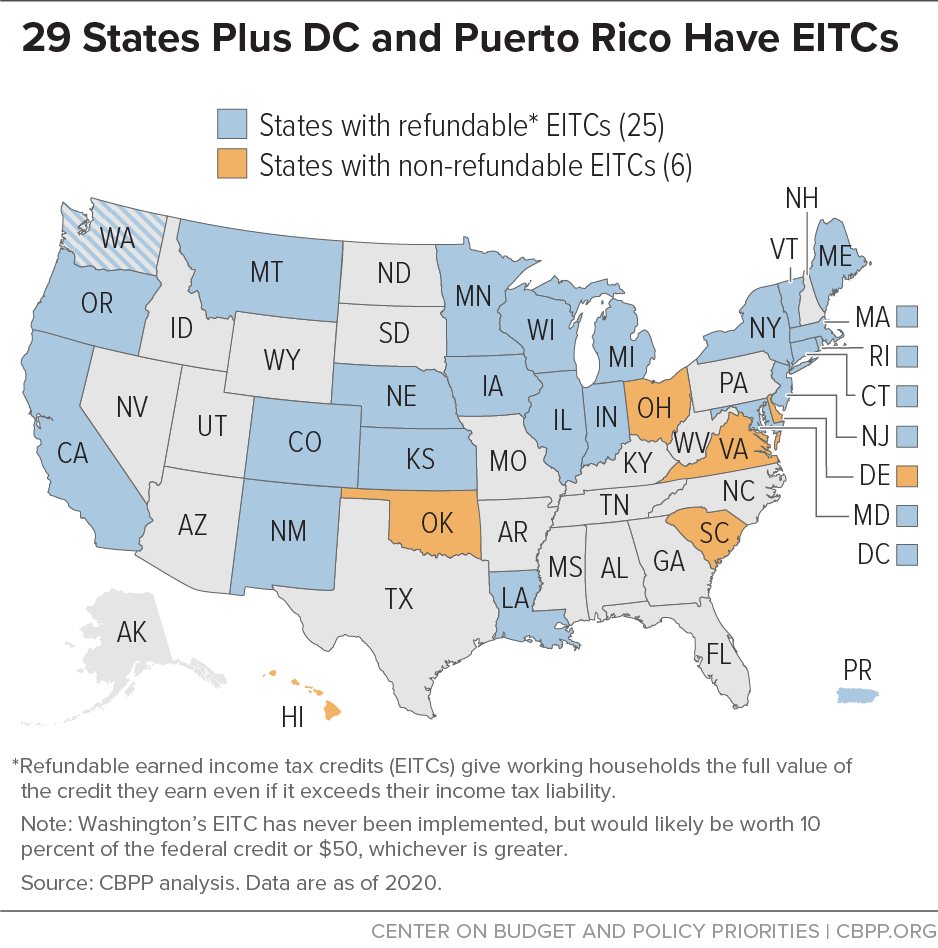

29 States Plus Dc And Puerto Rico Have Eitcs Center On Budget And Policy Priorities

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Puerto Rico Settlement Patterns Britannica

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22

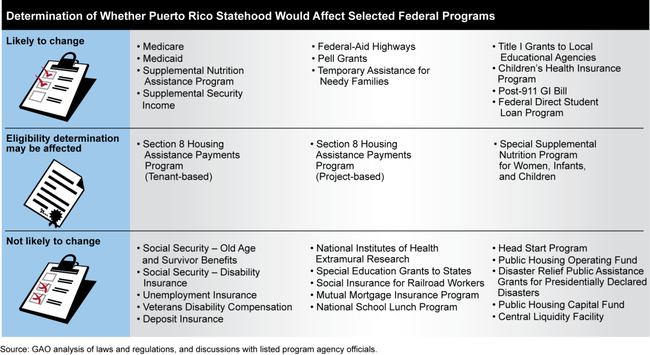

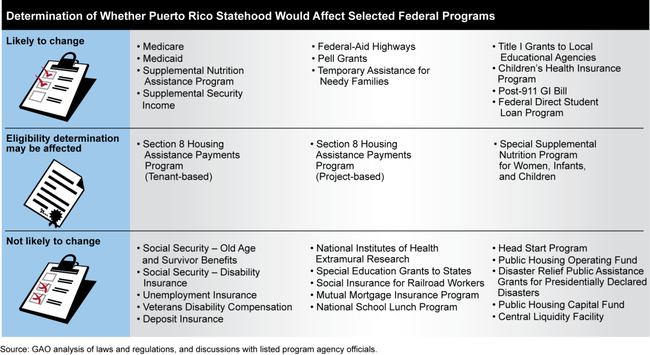

Puerto Rico Information On How Statehood Would Potentially Affect Selected Federal Programs And Revenue Sources U S Gao

Puerto Rico Income Tax Return Prepare Mail Tax Forms

For Employers In Puerto Rico Impacted By Last Year S Catastrophic Hurricanes You May Now Be Eligible To Claim A Special Tax Credit

A Detailed Analysis Of Puerto Rico S Tax Incentive Programs Premier Offshore Company Services

Puerto Rico Settlement Patterns Britannica

Will Statehood Benefit Puerto Rico Puerto Rico 51st

Us Tax Filing And Advantages For Americans Living In Puerto Rico

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Child Tax Credit Now Available To Puerto Rico Puerto Rico Report

Puerto Rico Offers The Lowest Effective Corporate Income Tax

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22

Tax Incentives Is Relocating To Puerto Rico The Right Move For You