oklahoma franchise tax due date 2021

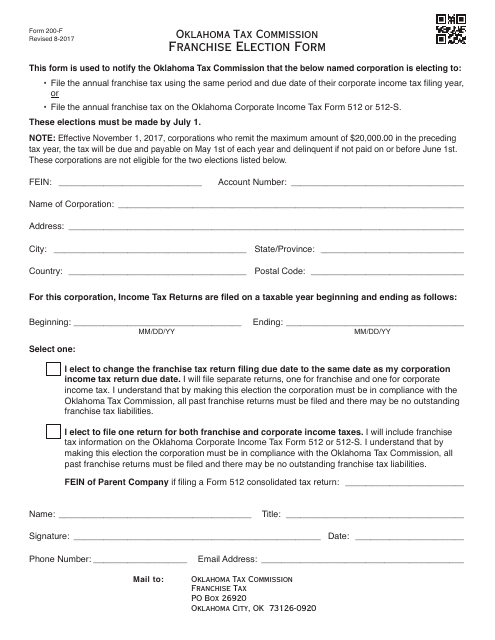

Franchise Tax Payment Options New Business Information New Business Workshop Forming a Business in Oklahoma Streamlined Sales Tax Forms Publications Forms - Business Taxes Forms - Income Tax Publications. Registrants can change their entitys tax filing date to the same schedule of filing as their corporate income and franchise taxes.

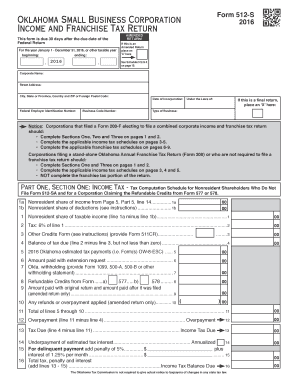

Oklahoma Form 512 Corporate Income Tax Return Form And Schedules 2021 Oklahoma Taxformfinder

Interest and late-filing penalties will not be applied to returns filed and payments made on or before May 17 2021.

. 31 2021 can be prepared and e-Filed now with an IRS or Federal Individual Tax Return or you can learn how to complete and file only an OK state return. Find IRS or Federal Tax Return deadline details. Nonresident Shareholder Agreement Income Tax Form Filing date.

OK tax return filing and payment due date for Tax Year 2021 is April 18 2022. 2020 Tax Payment Deadline Extension. Change Requested Avg.

Oklahomans have until then to pay their 2020 individual and business income taxes and their first quarter 2021 estimated income tax payments. Instructions for completing Form 512-S Form 512-S. For these corporations franchise tax is due and payable on May 1 of each year and delinquent if not paid on or before June 1.

Current tax statements are mailed. Small Business Corporation Income Tax form Form 512-S-SUP. For the Year 2021 S Corp Tax Returns are Due on March 15th 2022You need to either file your tax return 1120S by this date or request for an extension by filing form 7004 with the IRS.

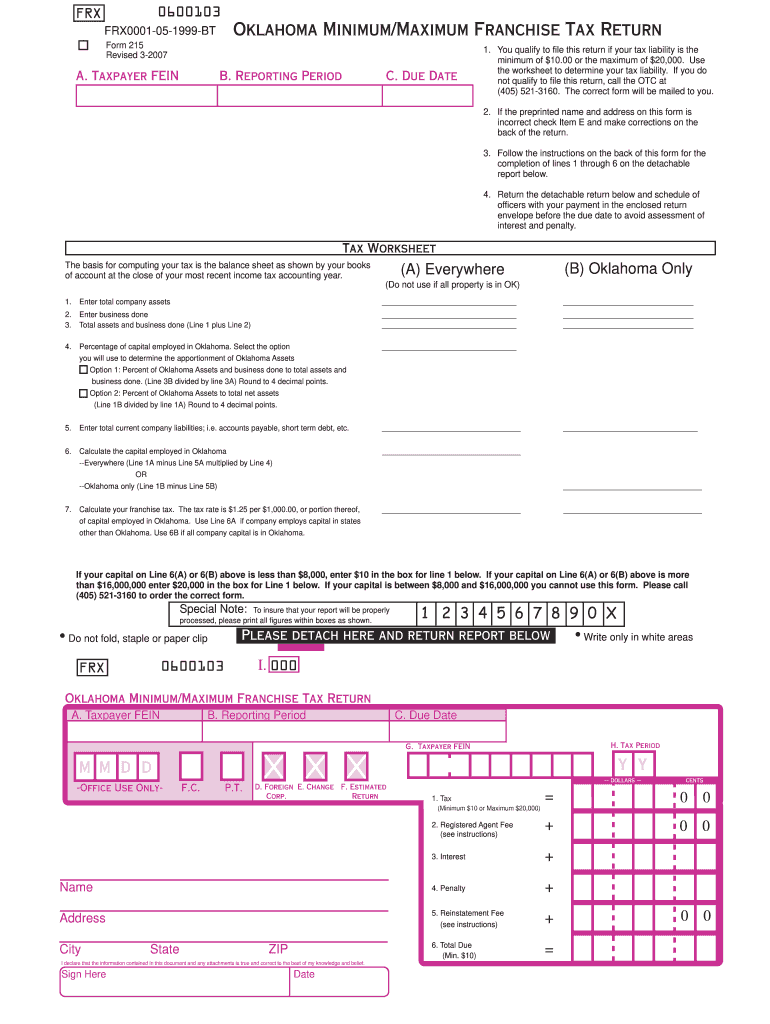

See page 18 for methods of contacting the Oklahoma Tax Commission OTC. These corporations are not eligible for the two elections listed below. Oklahoma Franchise Tax Instructions 2021 Oklahoma Franchise Tax Instructions 2021 2020 oklahoma franchise tax instructions.

Form 200-F Revised 9-2021. 15 is the extended due date. Due Dates for Taxes Fees and Information Reports Texas Franchise Tax Return Due Date 2022.

Any taxpayer with an Oklahoma franchise tax liability due and payable on or before July 1 2021 will be granted a waiver of any penalties andor interest for returns filed by August 1 2021 provided payment is received by September 15 2021. Effective November 1 2017 corporations who remit the maximum amount of 2000000 in the preceding tax year the tax will be due and payable on May 1st of each year and delinquent if not paid on or before June 1st. A ten percent 10 penalty and one and one-fourth percent 125 interest per month is due on payments made after the due date.

Delaware Captive Insurance Legislation Signed by Governor Date Posted. The Oklahoma franchise tax is due by July 1st each year. Your Oklahoma return is due 30 days after the due date of your federal return.

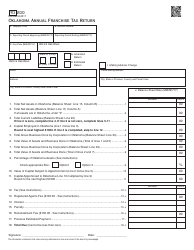

The remittance of estimated franchise tax must be made on a tentative estimated franchise tax return Form 200. Oklahoma Tax Commission PO Box 26890 Oklahoma City OK. If a taxpayer computes the franchise tax due and determines that it amounts to 25000 or less the taxpayer is exempt from the tax and a no tax due form is required to be filed.

2021 Oklahoma Small Business Corporation Income and Franchise Tax Forms and Instructions This packet contains. The report and tax will be delinquent if not paid on or before September 15. As a S Corp OwnerShareholder its important to know the S Corp Tax Return Due Date for 2021-2022.

Mail Form 504-C Application for Extension of Time to File an Oklahoma Income Tax Return for Corporations Partner-ships and Fiduciaries with payment if applicable to. The extension is automatic and no special requests are needed according to the Oklahoma Tax Commission. Income reports and tax payment must be received by the fifteenth 15 day of the third month from the end of the corporations income tax year.

Interest at the rate of 125 per month shall be paid on the tax due from the original due date until paid. 90 of the tax. 2019 Oklahoma Corporation Income and Franchise Tax Forms State of Oklahoma 2021 Form 514 Oklahoma Partnership Income Tax Return Packet Instructions State of Oklahoma.

S Corp Tax Filing Deadline 2021-2022. 2019 Oklahoma Corporation Income and Franchise Tax Forms State of Oklahoma 2021 Form 514 Oklahoma Partnership Income Tax Return Packet Instructions State of Oklahoma. The Delaware annual report and franchise tax payment are both due by March 1.

2020 Quarterly Tax Form For use by captive insurers that pay more than minimum tax and choose to pay the estimated tax quarterly. Taxes first become due and payable. T o avoid a.

It also extended the franchise and excise tax due date from April 15 2021 to May 17 2021 for individuals who file a franchise and excise tax return using Schedule J2 Computation of Net Earnings for a Single Member LLC Filing as an Individual. Interest at the rate of 125 per month shall be paid on the tax due from the original due date until paid. Oklahoma County Treasurers Important Dates.

County Assessor certifies the tax amounts to be collected. Both the state of Oklahoma and the Internal Revenue Service extended tax payment deadlines too. Up to 10 cash back For individual income corporation income and franchise fiduciary income partnership and partnership composite tax returns and payments with original or extended due dates on or after February 11 2021 and before June 14 2021 the automatic extended due date is June 15 2021.

Supplemental Schedule for Form 512-S Part 5 Form 512-SA. Oklahoma State Individual Taxes for Tax Year 2021 January 1 - Dec. Oklahoma Franchise Tax is due and payable July 1st of each year unless a Franchise Election Form Form 200-F has been filed.

Any taxpayer with an Oklahoma franchise tax liability due and payable on or before July 1 2021 will be granted a waiver of any penalties andor interest for returns filed by August 1 2021 provided payment is received by September 15 2021. Last day to pay full amount or one half payment of taxes before becoming delinquent. Pursuant to OAC 71050-17-1 the Oklahoma Small Business Corporation Income and Franchise Tax Return must be filed electronically.

Fillable Online Form 512 S Fax Email Print Pdffiller

Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

2020 Tax Deadline Extension What You Need To Know Taxact

Fill Free Fillable Forms For The State Of Oklahoma

How Failing To File Franchise Tax Returns Causes Personal Liability Texas Tax Talk

Otc Form 200 F Download Fillable Pdf Or Fill Online Franchise Election Form Oklahoma Templateroller

Texas Franchise Tax Report Report Year And Accounting Period Explained C Brian Streig Cpa

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

2021 Federal State Tax Deadline Extension Update Picnic S Blog

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

What Is Privilege Tax Types Rates Due Dates More

Incorporate In Oklahoma Do Business The Right Way

2021 Form Ok Frx 200 Fill Online Printable Fillable Blank Pdffiller

2007 2022 Form Ok Otc 215 Fill Online Printable Fillable Blank Pdffiller

Complete And E File 2021 2022 Oklahoma Income State Taxes

2007 2022 Form Ok Otc 215 Fill Online Printable Fillable Blank Pdffiller